Blog

First time around?

Friday, April 29, 2016

The chancellor’s Budget in March offered first-time buyers a generous bonus in the shape of a new Lifetime Isa, available from April 2017, to be used for a deposit on a first property. It has been suggested that more is needed for aspiring homeowners to make that all-important first step on the property ladder. Slow growth in salaries, job insecurity and rising house prices due to limited supply have delayed that first step for many first timers trying to accumulate a deposit. Many in their 30s are still unable to buy, with the average house price at ten times their salary, and the gap is increasing. For some a loan from the "Bank of Mum and Dad" is a possibility but others have to sacrifice a social life and live at home or rent whilst saving for a deposit.

There are, however, grounds for optimism. The number of people buying their first home increased by 6.6% year on year and figures are showing a steady growth in first time buyer confidence. Statistics show that the costs of buying and owning a first home have stabilised in February, with lower borrowing costs balancing out increased purchase prices and deposits. February’s average mortgage rate is the lowest mortgage rate for first time buyers in over five years and the amount of first time buyer income that is consumed by monthly mortgage repayments has hardly changed year on year. From February 2015 to February 2016 it rose by just 0.8% to consuming 20.4% of first time buyers’ monthly income.

Following a few months of intense competition from Buy to Let investors, and with a 3% Stamp Duty premium in place on second properties, first time buyers can at last start to press home the financial advantage they now have over landlords. Factor in a flurry of Government-backed schemes that support the key challenge of saving for a deposit AND make the home purchase more affordable, and getting on the first rung of housing ladder now seems achievable.

Housing and Planning Minister Brandon Lewis highlights the Government schemes that could help those aspiring to purchase their own home – some 86% of people in the UK (according to the British Social Attitudes Survey). Schemes include:

Help to Buy: Equity Loan. If you want to own a new-build home in England, you could borrow 20% of the purchase price from the government, meaning you would only need a 5% deposit as a 75% mortgage makes up the rest.

Help to Buy: Mortgage Guarantee. If you’re struggling to afford a higher deposit, you could buy a new-build or an older home anywhere in the UK with just a 5% deposit.

Help to Buy: ISA. If you’re saving towards your first home, this will boost your savings by up to 25% From April 2017, for every £200 you save the Government will top it up with £50.

Right to Buy. If you’re a council tenant in England the Right to Buy scheme could help you buy the home you rent with a discount of up to £77,900.

Starter Homes. If you’re a first-time buyer the Starter Homes scheme could help you buy a new-build home with a 20% discount.

Shared Ownership. If you can’t quite afford to buy 100% of a home, you could buy a share of your home instead and pay rent on the rest.

Latest figures from the government show that nearly 130,000 people across the UK have used the Help to Buy scheme since its introduction in 2013, with more than 90,000 of those being first-time buyers. This figure is set to rise dramatically with the introduction of the new Help to Buy London scheme, designed to assist hopeful first time buyers in the capital.

Miles Shipside, Rightmove director and housing market analyst comments: “Encouragingly for first-time buyers there’s fresh choice with more property coming to market in their target sector. With their asking prices pretty much the same as a month ago, perhaps the knock-on effects of the more punitive landlord tax regime have arrived early and they now face a dilemma over whether to buy now or wait and see if prices drop in this sector over the next few months.”

First-time home buyer guide

If you’ve decided you’d like to own your own home, there are a few things you can do to make the process easier. From saving for a deposit to the mortgage application process, these are the initial steps.

• Start saving for a deposit. You’ll need to save 5% to 20% of the cost of the home.

•Make sure you can afford your monthly repayments. Lenders will check that you can do this and will also ‘stress test’ your ability to make your payments if interest rates were to rise or if your circumstances change.

•Plan for the other costs of buying a home including: Mortgage arrangement and valuation fees, Stamp Duty, solicitors’ fees, survey costs, removal expenses, furnishing and decorating, buildings and contents insurance

•Look at schemes to assist you including Help to Buy schemes, shared ownership schemes

•Find a mortgage. Do your research and talk to experts – we can put you in touch with respected independent mortgage advisors.

Above all, weigh up the pros and cons of owning a home before investing emotionally and financially in the process. The advantages obviously include the pride of having somewhere you can put your mark on and really call your own but, more than that, somewhere with potential for improvement and for capital growth. Home ownership may even improve your credit rating. As long as regular payments are made, it’s a way to show lenders you’re in control of your finances.

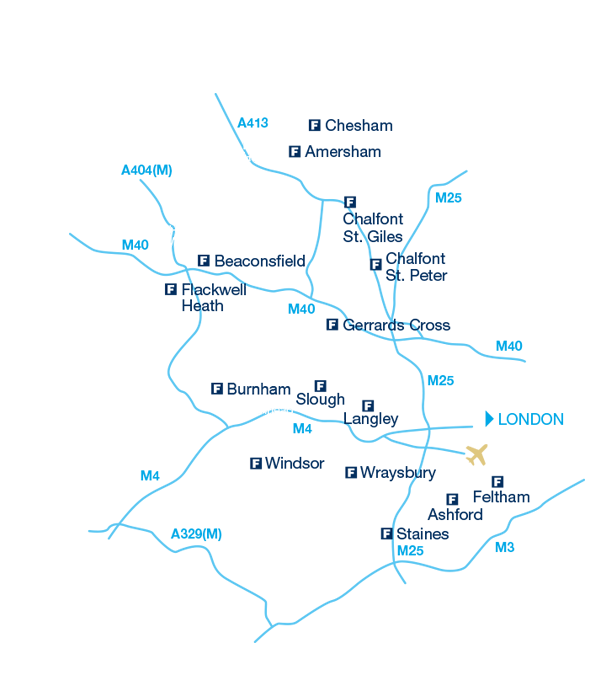

As always with property, and especially for first time buyers, location and affordability are the main factors to consider. For those priced out of London, a Telegraph survey recently highlighted Staines and Feltham as affordable areas within easy commute of the capital. This is reflected in the fact that 33% and 45% of sales respectively in those areas were to first time buyers. Looking ahead, Crossrail is opening up the commuter corridor with Slough area property prices forecast to rise by as much as 49% with the advent of Crossrail. Research and local knowledge is key to finding a property that’s right for you and is likely to appreciate in value. The Frost Partnership’s buyers guide is designed to give you a quick and simple summary on what’s involved in the process of buying a property and may answer some of your questions or contact your local property expert for details of all our suitable properties in your area.