Buy a new home for investment

Whether this is your first property investment or you are a seasoned investor, we can help you find the right property and achieve maximum value from your investment.

Purchasing a New Home as a buy-to-let investment should be considered a medium to long-term investment, ideal for those who prefer to invest in a tangible asset unlike stocks and shares. It can be even more financially rewarding if you pay a large percentage of the deposit on a buy-to-let property, especially when you compare it to low saving rates and possible stock market volatility. Property prices can fluctuate however, so buying a property with less maintenance issues will help keep costs to a minimum. For this reason investing in New Homes could be a wise move.

The following short guide is designed to give you a quick and simple summary on buying to let, whether you are simply dipping your toes into the water or looking to expand your property portfolio. For more information download our buy-to-let guide.

Start your property search

- View all the latest New Homes for sale

- Sign up for property alerts

- Discover more about the areas we cover

- Review our Buying guide

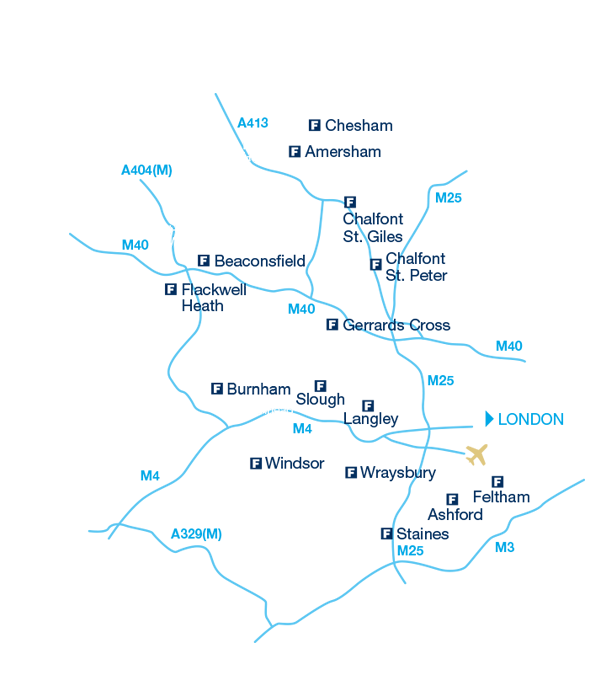

Which areas would you consider buying in?

Research your area. Getting to know the area in which you wish to purchase your buy-to-let property is vitally important. Schools, shops and transport links will appeal to tenants. All the areas we cover offer excellent transport links via railways and the motorway network including the M25, M4 and M40 - ideal for commuting to London and Heathrow airport.

Search our residential sales database by:

Financing your buy-to-let property

The two most important aspects of an investment property are that it financially works for you and that the property appeals to the right tenants to maximise a good rental yield.

- Mortgage advice. We work with reputable, trusted independent mortgage advisors who carefully assess your circumstances and help you find your target property price and help you get the best possible mortgage.

- How much is your property worth? Contact The Frost Partnership for a free, no obligation market appraisal or complete our online valuation enquiry form. Some developers offer the option to negotiate a part exchange on your home, contact us to find out more information.

- Help to Buy Scheme. Help to Buy is a temporary government-financing scheme designed to help you get on the property ladder.

Have you thought about property management?

Whether you have one or more investment properties to manage, rental renewals and property management issues can take up valuable time. By appointing The Frost Partnership to manage your property, we deal with everything right through to the end of a tenancy and any disputes that may arise when a tenant vacates your property.

Our property management service makes investing and managing tenants easy. Learn more about our property management services.