Blog

Is Buy To Let a good investment?

Thursday, March 8, 2018

With current low savings interest rates, many investors have sought alternative investment options and actively considered buy-to-let (BTL). Since 2016, however, UK landlords in the private rental sector have faced a number of tax changes, potentially making it harder to profit from buy-to-let; a 3% surcharge in capital gains tax on new BTL purchases and a reduction in the tax relief that can be claimed against mortgage costs, coupled with tighter lending standards, have lowered profit margins.

While average property price growth across the UK has flattened somewhat in the last 6 months, rents have increased, with more tenants chasing a limited supply of rental property. Depending on the type of property and its location, BTL yields can still reach 5 -10 %; significantly more than any savings account will currently pay. In many areas, landlords can also be fairly confident that property values will continue to appreciate steadily to achieve a long-term profit via capital growth.

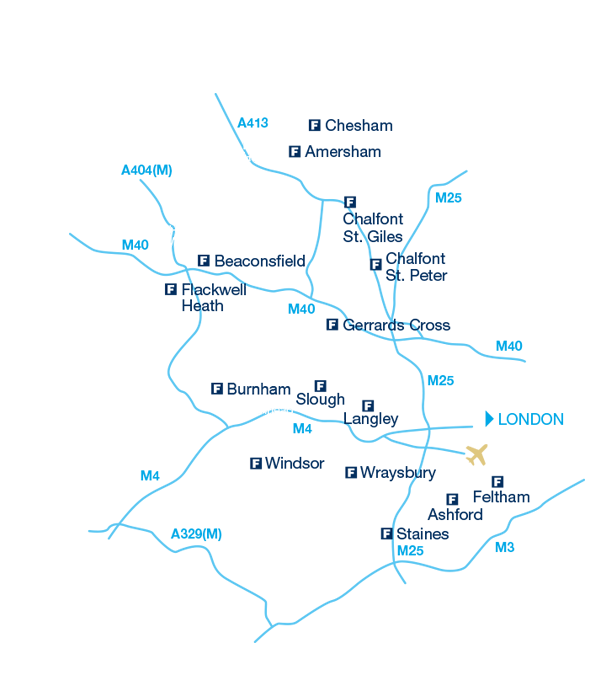

Strong rental demand is key to prevent lengthy void periods and the demand is there: English Housing Survey’s most recent data reveals that the private rental sector now houses 20% of the UK population, including nearly 2m families with children. The big question is where to invest to maximise returns and achieve capital growth? At Frosts, with experienced sales and lettings staff in every branch, we have extensive local knowledge about which properties deliver the best rental return. We can highlight the best areas regarding supply and demand, advise on yields and minimising 'void' periods. Depending on the area for example, it may be worth spending more to refurbish a property and arrange property management in order to attract corporate tenants.

It’s essential to do the maths and make sure you have thought about everything that renting out a property entails before committing to a mortgage and becoming a landlord. You’ll want to be sure you can earn enough rent to make the investment worthwhile and factor in contingency for emergencies. Getting the best mortgage deal is vital. You need a mortgage specifically designed for BTL and must tell lenders if you intend to rent the property out. BTL mortgages typically cost 1-2 % more than residential loans because they pose a bigger risk to the lender. But there are competitive rates out there. BTL mortgages normally require a higher deposit too, typically 25%. Arrangement fees can be £2,000 or more adding significantly to the cost of borrowing so make sure you get impartial advice and compare the best rates on the market.

The key lending criteria is how much rent you’ll be able to charge. Lenders typically look for a potential monthly rental income of at least 125% of your monthly mortgage interest payments. Speak to your local Frost office to find out how much similar properties are on the market for and use a BTL calculator to work out how much you could borrow. Factor in the cost of getting the property ready for market and ongoing costs such as maintenance, buildings insurance premiums and agent fees if applicable.

It’s worth seeking advice from your local ARLA lettings agent; never underestimate the work involved in letting a property, even if you use a letting agent. There are many considerations; legal and health & safety regulations, property maintenance, insurance and mortgages to name but a few. It’s a big decision and you may feel you need professional advice to avoid the pitfalls. Our lettings guide can guide you in becoming a landlord for the first time. Be realistic. It’s not a “get rich quick” scheme and requires considerable effort to find the right property, prepare it for tenants, meeting health and safety requirements and legal obligations. When house prices are rising and you have good tenants, BTL investment seems like easy money. But there are risks too.

By instructing Frosts, your money is protected by ARLA’s Client Money Protection Scheme and Professional Indemnity Insurance. Our 12 month Rent Guarantee and Legal Protection cover is FREE of charge subject to the tenant passing the reference check and offers you complete peace of mind. When it comes to health and safety, it’s vital to abide by ever-changing legislation, to protect your tenants and avoid potentially serious accidents. We will ensure you are kept up to date with any changes in legislation.

Buy-to-let property can be a great way to invest for the future, but it’s important you go into it with your eyes wide open. It’s a good option for those looking for a medium to long-term investment and who prefer a tangible asset, currently offering better returns than savings accounts particularly when you factor in the potential for capital growth over the longer period. To view some of the current buy-to-let investment properties marketed by The Frost Partnership click here or for more information read our Buy to Let investment guide . To discuss Buy to Let and for FREE no obligation advice, please contact your local Frost Partnership office.