Commercial property buying guide

If you are looking to buy a commercial property our Buying guide will help provide you with important information about commercial property classifications, costs involved with purchasing a property and what you need to be aware of prior to purchasing.

1. Let us know you are looking

The first step to finding the right commercial property is by letting us know what you are looking for. Contact our commercial team or register your property search requirements online with us. We will either contact you by phone or send you email updates when properties that fit your search criteria are available.

2. Start your property search

- View all our latest commercial properties for sale

- Sign up for Property Alerts to instantly receive emails about properties you are interested in

- Review our area guides

3. Finding a suitable property

There are a number of factors that should be considered before choosing a property. Prioritise what’s most important:

- What type? Office space, industrial space or retail outlets?

- What size do you need? Do you require lifts to serve all floors?

- What impression does the commercial property need to give to your clients, customers, suppliers and potential staff?

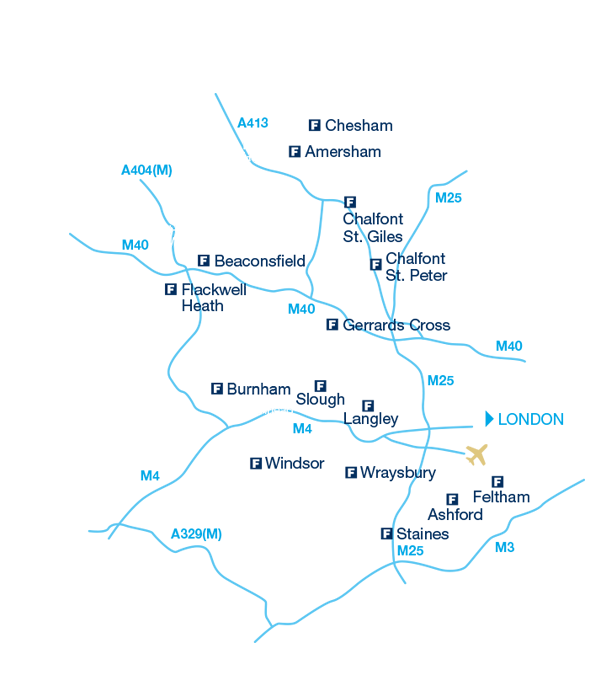

4. Choose the right location

The Frost Partnership area guides provide further information on the areas we operate in Buckinghamshire, Berkshire and Middlesex. All the areas offer excellent railway and motorway transport links to London, Reading and Heathrow airport.

Choosing a suitable location for your business is a key factor to get right as it affects the suitability of a property for your business, clients, customers and employees.Have you considered whether you need to be located in a business or retail park, industrial estate or in the middle of the town?

Other considerations may include:

- Parking or parking restrictions for employees, clients or suppliers

- Easy access to public transport links

- Attracting passing trade/ footfall

- Delivery factors for machinery or products

5. Commercial property class and use types

Commercial properties and land are divided into different categories known as class or use types, allocated and governed by The Town and Country Planning (Uses Classes) Order 1987. If you are buying a commercial property for your own business, your business needs to match the class type allocated to the property - some properties can be converted to different class types without the need for applying for planning, others may require planning

Table 1: Commercial property and use class.

If the property you wish to buy requires planning and change of class/use, this might require you to oversee structural or decoration changes to the property, resulting in additional costs from services such as:

- Planning services

- Architect

- Structural engineers

- Building control services

- Project management

- Building contractor

- Quantity surveyor

- Space planner

The Frost Partnership can guide you through the application process. Please contact The Frost Partnership Commercial team for more information.

6. Costs involved

- Fees for any professional advisers (agents, surveyors, solicitors etc.)

- Mortgage fees, if applicable

- Business rates, if applicable

- Insurance

- Repairs, maintenance, decoration and relocation

- Stamp Duty Land Tax ranges from 0%- up to 4% for properties over £500,000

- Deposit. This is in general equivalent to around 20% – 30% of the commercial property value

- VAT, if applicable

Our Commercial agents will provide additional information so that you are fully aware of all the costs involved with the property you wish to purchase. Contact The Frost Partnership to start your search.

7. Commercial property mortages

If you need to obtain a commercial mortgage to finance your property purchase then you need to find a lender who can offer you the best deal. Contact our commercial team if you would like to be introduced to our trusted, reputable independent mortgage advisors who can help you find the best mortgage rate deal for you and your business.

The higher the deposit you invest in your property (greater than 25% of the purchase price) the more attractive it will be for lenders who will view your loan application as lower risk. Lenders will likely require information about your business, such as:

- A detailed business plan and information about how your intend to repay the loan

- Current business performance

- Profit and loss forecast for the next year

- Business bank statements for the previous 6 months prior to your application for a loan

- Review your audited accounts for the last 2 years

- Asset and liability statements for each applicant

- Details about all the partners and directors of your business

8. Commercial Energy Performance Certificate

A commercial Energy Performance Certificate (EPC) informs you about the energy performance of a property. It is the seller’s responsibility to prepare and provide a commercial EPC prior to the property being marketed. Energy ratings on an EPC vary from ‘A’ representing the most energy sufficient to ‘G’ the least energy efficient. The EPC ratings for newer properties should be better than older buildings. If the property you are interested in has a low rating, you may be able to negotiate the price.

9. Making an offer to buy a commercial property

When you have found the commercial property right for your business needs then your agent will help negotiate your offer and the terms of contract – it is worth noting that not until the contracts are signed and completed will the property be withdrawn from the market. At this time there is little to prevent the seller from negotiating with another interested buyer. However, by placing a firm offer and providing written proof of your ability to fund the transaction (with the help of your lender if applicable), especially if you already have a guaranteed mortgage offer, this could help influence the sellers’ decision.

10. Appointing a solicitor

Appoint a solicitor to act on your behalf to apply to the local authority for the relevant surveys. These surveys provide research and detail about the condition of the structure of the property and the land it is built on. The main purpose of the surveys is to look into any plans that may affect the property in anyway and to ensure there will be no unpleasant surprises or hidden costs after you have purchased the property. The majority of commercial property transactions require surveys to be undertaken as part of the conveyancing process and surveys typically take around two to three weeks to complete. However you can expedite these surveys at an additional cost by instructing a qualified agent to carry out the survey.

Results will reveal planning applications that may be relevant to the property, either current or historic, building ownership history, nearby road schemes and motorways, developments and contaminated land etc.

You may wish to undertake additional searches to cover other eventualities such as radon gas or flood risk assessments.

11. Exchange of contracts and completion

When you and the seller have reached an agreement with the price and details of the contract and you are satisfied by the surveys and all the necessary checks and inspections of the building, then money will need to be raised to complete the final part of the transaction, the deposit. The deposit is usually ten percent of the purchase price but can be varied, subject to prior agreement. Completion is when you pay the remaining balance and then the contract is 100% complete.

Congratulations, you have now become the owner of a commercial property.

Following completion, you are required to:

- Pay Stamp Duty Land Tax

- Register your ownership with the Land Registry

- Register your commercial property with health and safety, if applicable

- Advise the business rates department of your ownership or occupation

- Edit or update your utility contracts contact details

12. Property management

Managing tenants and property during the lease term can be time consuming. Our commercial property management services include; tenant sourcing, day-to-day management of maintenance issues, rent reviews, lease renewals, dilapidation concerns and more.