Commercial property investment guide

Whether you are a seasoned investor or just looking to build your property portfolio, our investment services include acquisitions and disposals, tenant and property management, as well as providing expert advice and strategies about how to grow the value of your commercial portfolio assets. This commercial investment guide provides an important summary on what you need to consider and how to get started.

1. Find a commercial property for investment

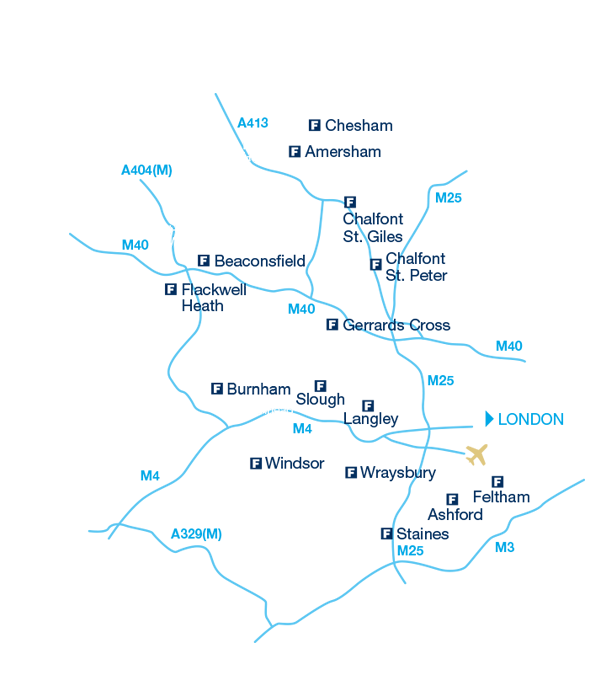

The Frost Partnership operates throughout South Buckinghamshire, Berkshire and Middlesex. All the areas we cover have excellent transport links to London, Reading or Heathrow airport and offer a broad range of commercial properties from: office buildings, retail stores, warehouses, vacant land, commercial agricultural land, even car parks.

- Let us know you are looking

The first step to finding the right commercial property is by letting us know that you are looking, so please contact our commercial team or register your property requirements with us - Start your search

View all our latest commercial properties for sale - Read our guides

Commercial buying guide, Commercial selling guide, Commercial lettings guide, Buy-to-let investment guide, Commercial property jargon buster

2. Financing your commercial investment property

The volatile stock markets over the last few years have made buying property much more attractive to investors. Investing in property is regarded as a tangible way to invest your money.

- Finance

We work with reputable, trusted independent financial advisors who carefully assess your circumstances, help you find your target property price and help you get the best possible mortgage or buy-to-let mortgage. - Re-mortgage / release equity

Have you thought about releasing equity in your other existing property investments to fund a new purchase? Arrange a valuation of your property, or speak to our independent mortgage advisors to determine the right mortgage for you.

3. Managing your property portfolio

The key to successfully managing your property portfolio is in handling all the many regulations that govern the relationship between commercial landlords and tenants. Attending to property maintenance issues and managing tenants can take up valuable time. If you have more than one property to attend to you may want to consider our commercial property management services to help you manage your property and tenants effectively. This enables you to look at the bigger picture and find new investment opportunities. Our property management services include:

- Tenant sourcing, advertising and marketing

- Rent collection

- Rent reviews

- Lease renewals

- Business rates

- Service charges

- Property maintenance

- Statutory legislation schedules of dilapidation and repairs

4. Portfolio valuations

Our expert valuation team provides commercial valuation services on retail outlets, office space and industrial units, from one-off valuations to valuations of entire portfolios. All valuations are market-based, onsite inspections.

Our valuation experts are qualified chartered surveyors, with years of local property knowledge and experience; qualified to provide a range of valuation and surveying services:

- Appraisals to ensure the property is priced correctly

- Mortgage or loan security valuations – to help refinance your property

- Asset valuations to ensure your property is structurally sound before you invest in it

Our valuations enable you to make informed decisions about your next investment acquisition or disposal.

5. Growing your commercial property portfolio

Our goal is to achieve maximum investment performance from all your commercial property investments.

We work with investors, pension funds, developers, venture capitalists or high net worth individuals to source, evaluate and acquire property that complements the performance of their property portfolio and personal risk profile.

- Review your property portfolio

Let us take a fresh look at your assets and find the right way to maximise their performance. We can identify ways to increase their profitability through - rent reviews, lease expiries, negotiate to remove break lease options, arrange disposals or acquisitions of new investment opportunities. - Tenants in situ

Investing in properties that offer tenants in situ will provide additional advantages such as being able to instantly calculate your finances and receive rental yield from day one. Contact our commercial team for more information on properties with tenants in situ. - Single unit strategies

One way to maximise rental income and minimise any void rental periods when your investment property is without a tenant - is by investing in single units rather than a large property with one tenant. This way you spread the risk of not having tenants or rental income at any time. Single units allow you to have 70% occupancy - while you find the new tenant to move in and pay the other 30% for example.

Growing a property portfolio can take a long time. The longer the time you allow your investments to mature, the more financially rewarding it can be in the long run. Speak to one of our commercial agents to help get you started.

For more information about our investment services Contact our commercial team on 01494 680909