Blog

First foot on the ladder

Thursday, May 24, 2018

Official figures show that the number of first-time buyers reached its highest for 10 years in 2017 with 365,000 taking ownership of their first home last year, up 7.4% on 2016 and the highest number since 2006, according to UK Finance, the trade body for Britain’s banks. The government’s Help to Buy programme, lower deposit and cheap mortgage deals and a cut in stamp duty in the November budget saving first timers up to £5,000 have all contributed to the increase, assisting those getting started on the housing ladder. First-time buyers have a vital role to play in the housing market, with each transaction having an impact further up the chain.

Statistically, the average first-time buyer (FTB) is 30 years old with an income of £41,000. Land Registry figures for February 2018 reveal the average UK house price has broken new ground at over £225,000 whilst the average FTB deposit has more than doubled from £15,000 in 2006 to over £33,000 in 2017. With low interest on savings, a large deposit required and increasing rental costs, times are tough. Even so, there are almost 1,000 FTBs a day in the UK securing a mortgage, and with a 3% Stamp Duty premium in place on second properties, they can at least now claim a financial advantage over landlords.

If you’re looking to buy your first home, you will need a deposit of at least 5% of the property’s value. In addition, you need to factor in the other costs of buying a home -mortgage arrangement and valuation fees, stamp duty, solicitors’ fees, survey costs, removal costs, furnishing and decorating before calculating whether you can afford your monthly mortgage repayments, buildings insurance and utility bills!

If you are looking to benefit from one of the government-backed schemes such as the Help to Buy ISA or Starter Homes Scheme, you should seek independent advice from a professional financial adviser who will be able to guide you through the steps and recommend the right scheme for you. The Frost Partnership has established relationships with trusted advisors (http://www.frostweb.co.uk/mortgage-advice.html) who are truly independent and therefore able to search thousands of mortgage deals to find the one that suits you best.

There are ways to make the buying process easier; from saving for a deposit to applying for a mortgage, these are the initial steps: • Start saving for a deposit. You’ll need to save at least 5% of the cost of the home. •Make sure you can afford your monthly repayments. Lenders will check this and will ‘stress test’ your ability to make payments if interest rates go up or your circumstances change. •Plan for all the associated costs listed above •Consider schemes to assist you including shared ownership schemes •Find a mortgage. Do your research and talk to experts such as mortgage brokers*

Above all, weigh up the pros and cons of owning a home before investing emotionally and financially in the process. The advantages obviously include the pride of having somewhere you can put your mark on and call your own but also somewhere with potential for improvement and for capital growth.

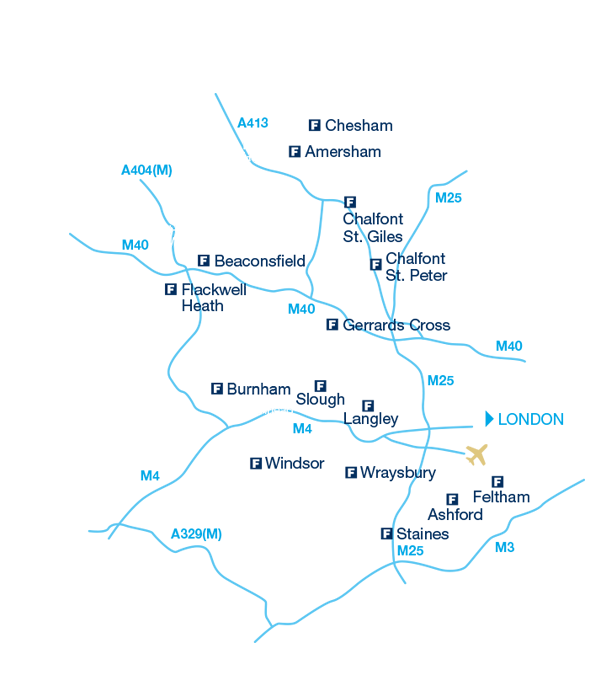

Location and affordability are key. For those priced out of London, a recent survey highlighted Staines, Slough and Feltham as affordable areas within easy commute. Crossrail is opening up the commuter corridor with Slough property prices forecast to rise significantly. Research and local knowledge are vital to finding a property that’s right for you and one that is likely to appreciate in value. Talk to your local Frost office; with 15 linked offices across Buckinghamshire, Berkshire and Middlesex, we may be able to suggest an area which you had not previously considered but which meets all your requirements and is more affordable.

The Frost Partnership’s buyers guide is designed to give you a simple summary of what’s involved in buying a property. It covers the entire process from property search to completion, including finance, surveys, conveyancing and exchange of contracts. Whether you want to get onto the housing ladder or move up it, your local Frost team can answer your questions and provide you with details of suitable properties in your area. Contact us now and we’ll help you to get it right the first time!

*Your home may be repossessed if you do not keep up repayments on your mortgage. There will be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances. The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.